As we hear daily, 'circling back'

to JOUT results....

How's JOUT's stock performing? Quite well

- Up ~70% in the last six months

- Up over 540% in the last five years

- Outperforming IXIC at ~ +175%

- And its peer reference IWM at ~ +110%

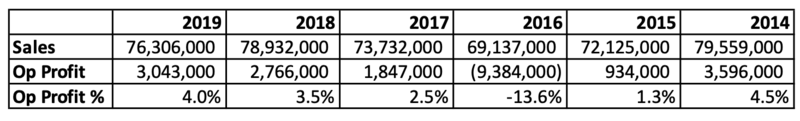

And the Diving Segment of JOUT, year end ~OCT? Not so well.

- Diving Net Sales / Operating Profits (rounded)

- 2020, $61m, -2.6m

- 2019, $76m, +3m

- 2018, $79m, +2.8m

- 2014, $80m, +3.6m

JOUT is primarily a 'fishing company', with 75% of sales coming from this category.

Diving accounts for ~10% of sales

Capital Expenditures - 2020

- Fishing, ~82%

- Diving, ~6%

FY2020 vs, FY2019

- "Diving net sales decreased $15,433, or 20%, year over year. The decrease is largely due to the effects of COVID-19 on demand globally due to restrictions in destination travel and tourism."

- "The $8,467 decrease in gross profit in the Diving segment was due primarily to decreased sales volumes during fiscal 2020 as compared to the prior year."

- "Operating profit for the Diving business decreased by $5,619 < >."

- "Growth in the US market was more than offset by declines in the Asia market and foreign currency translation, which negatively impacted sales by 3% in 2019 versus the prior year period.

Q1

- "Net sales of $165,667 for the first quarter of fiscal 2021 increased $37,613, or 29%, from the same period in the prior year, reflecting increased sales volumes across all businesses, except Diving, mainly attributable to increased participation in outdoor recreation activities as a result of social distancing and other indoor activity restrictions related to the COVID-19 pandemic."

- "Our customers’ inventory levels, were drawn down during the past fiscal year as consumers purchased related products, and accordingly, we experienced strong orders from our customers in the fiscal 2021 first quarter to fill their pipelines in anticipation of the fiscal 2021 warm-weather recreational season."

On to Q1, ending JAN 2021 vs previous year Q1

- Sales, 14M v 16M

- Profits, -341 v +205

IF JOUT were not a closely held company, one might speculate that they would sell the diving segment and push the capital to the fishing segment.

All things considered, the diving segment held better than might have been expected, having a minimal effect on sales/profits.

Good for the dive industry?

- Likely continuation of the consolidation trend - accelerated by online and shop closures

- Perhaps industry consolidation will help reverse the no growth dive biz?

The Risk Ahead - in the diving segment? IMO ...

- Asia, the only geographic area where the dive industry expected significant growth in the next five years - pre virus.

- USA/Europe - will divers return to LDS/Online and drive shops to increase orders?