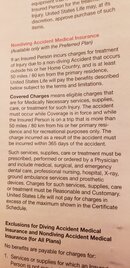

Has anyone tried to use their DAN Insurance for a non-diving accident? My coverage lists $10,000 life time benefit with a $250 deductible for non-diving accidents.

I was recently on a cruise ship where I came down with the flu and was treated by the doctors on staff. The total medical bill was $2600. I was hoping to file a claim with DAN but they told me that treatment for the flu is not considered a medical accident.

Has anyone else gone through something similar with DAN? Am I wrong to assume that my DAN insurance should help me cover this bill?

I was recently on a cruise ship where I came down with the flu and was treated by the doctors on staff. The total medical bill was $2600. I was hoping to file a claim with DAN but they told me that treatment for the flu is not considered a medical accident.

Has anyone else gone through something similar with DAN? Am I wrong to assume that my DAN insurance should help me cover this bill?