- Messages

- 53,673

- Reaction score

- 7,853

- # of dives

- 500 - 999

Gawd but I hate insurance. I used to sell it, made me hate it more. I do buy some of it, tho - with large deductibles as I really don't want to mess with claims unless it's pretty significant - along with the saved premiums. I've self-insured my gear & cameras for some time, but was looking at insuring all that and decided a comparison of choices was in order. Why hasn't someone else done this and saved me the trouble...?

Ok, so I gave it a shot. Please review my work and point out any errors, okay? I estimated that I might insure as much as $3,500 in gear and $1,500 in cameras. Probly not, but that's what I did the comparison on...

(1) Some would suggest a scheduled coverage rider on your homeowners insurance which could be cheaper & simpler in ways, however not everyone can do that, and - as some members pointed out in a discussion....

(2) D.E.P.P. is popular with many divers, so I looked at it.

First, join Coral @ $12 year. Looks like a scubaboard wannabe, but maybe it's an okay organization.

Then the equipment premiums must include my BC & Reg (perhaps to avoid being camera insurers only? don't know why?) and would be $95 base + $60 camera flooding in addition to the $12 Coral = $167.

I had to read the claims requirements more than once to ensure I wasn't halucinating...

Screen shots of some DEPP charts attached.

Remembering why I've always self-insured

(3) DAN is super on dive insurance. I feared that their equipment insurance might be something they added only because members kept asking for it - thinking they'd be good at that too, and they do contract it out...

Dissappointed

(4) Then I heard about State Farm's Inland Marine policy. I all of SB for discussions on this and it seems to be a pretty well kept secret, but not totally....

all of SB for discussions on this and it seems to be a pretty well kept secret, but not totally....

$3,500 sports gear: $116

$1,500 cameras: + $20

No Deductible

Hello State Farm - I think I'll be in good hands.

Ok, so I gave it a shot. Please review my work and point out any errors, okay? I estimated that I might insure as much as $3,500 in gear and $1,500 in cameras. Probly not, but that's what I did the comparison on...

(1) Some would suggest a scheduled coverage rider on your homeowners insurance which could be cheaper & simpler in ways, however not everyone can do that, and - as some members pointed out in a discussion....

Just be aware of an issue in some states which can affect you when insuring through your homeowners policy. In some states, if you have 2 claims in three years, of any type, against your policy, you could be subject to being classified high risk and at risk of losing your insurance. That is the case in Colorado. You can have one camera theft and a break-in on your car, neither one even related to damage to your home, and you are either uninsurable or at exhorbitant rates.

While I could insure my gear at a much lower cost than through DEPP, there's no way I'm going to let damage to my gear affect protection to my home.

REJECTEDIm an Insurance Adjuster and what (she) says is absolutely correct. While there are lots of reasons to have all your insurance needs provided by 1 company (agent), if you have 2 claims within 3 years you are subject to losing those policies. IE, you could be non-renewed.

A small additional premium for "Scuba" related gear, that might have a higher probability of you filing a claim, might be worth paying. You can maybe save a few dollars a year on your premiums by adding a rider to your homeowners policy or having an inland marine policy. But weigh whether it's worth possibily losing your homeowners coverage. I carry my scuba gear with a separate company than I have my homeowners coverage with.

(2) D.E.P.P. is popular with many divers, so I looked at it.

First, join Coral @ $12 year. Looks like a scubaboard wannabe, but maybe it's an okay organization.

Then the equipment premiums must include my BC & Reg (perhaps to avoid being camera insurers only? don't know why?) and would be $95 base + $60 camera flooding in addition to the $12 Coral = $167.

I had to read the claims requirements more than once to ensure I wasn't halucinating...

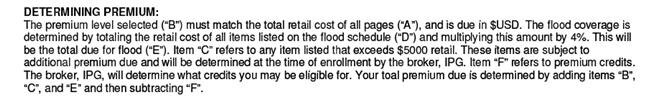

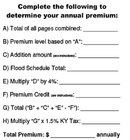

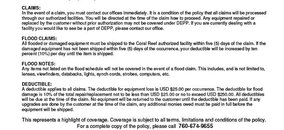

5 days of the accident or the claim? The latter I hope. This is the first time I have ever seen that the deductible - the greater of $25 or 10% must be paid at the time of claim?! I suppose that's because they're going to repair or replace my equipment, not send a check, but it seemed odd still.FLOOD CLAIMS:

All flooded or damaged equipment must be shipped to the Coral Reef authorized facility within five (5) days of the claim. If the damaged equipment has not been shipped within five (5) days of the occurrence, your deductible will be increased by ten percent (10%) per day until the item is shipped.

Screen shots of some DEPP charts attached.

Remembering why I've always self-insured

(3) DAN is super on dive insurance. I feared that their equipment insurance might be something they added only because members kept asking for it - thinking they'd be good at that too, and they do contract it out...

- Dive Equipment Insurance services are being provided by Senn, Dunn, Marsh, and Roland, LLC.

- Deductible $100; Water Deductible $250 or 10% loss, whichever is greater

- Cost to insure just a Reef Master SL155 Sealife DC500 Underwater Digital Camera Pro Set @ $732 = $99

Dissappointed

(4) Then I heard about State Farm's Inland Marine policy. I

all of SB for discussions on this and it seems to be a pretty well kept secret, but not totally....

all of SB for discussions on this and it seems to be a pretty well kept secret, but not totally....My company is USAA - and this coverage is a Personal Articles Floater (also known by some companies as "inland marine insurance"). It essentially covers all risks to specifically listed items on the policy. This is a separate policy from homeowners insurance and covers only those items specifically listed. Intentional DAMAGE would of course not be covered, but accidental flooding certainly should unless the policy specifically excludes it that as a cause of loss.

FWIW - for about $4500 worth of camera coverage, I am paying $48 per year.

Yes - they do put a nice note on the policy packet that says "you claims history may affect your coverage...."

I have a inland marine policy for covering my UW camera gear and its inusred through state farm. It covers everything from simple damage to lost or destroyed.

for 5200 worth of camera gear i payed $59 for all the coverage.

I also use State Farm.......my cost is $29.00 per year for $2000.00 in coverage.

The initial quote I got today...from the time that i informed them that my nikonos had flooded and it was confirmed by my photo tech, i had a check in hand in less then 4 business days. the start to finish ticket time was less then 30 days so i consider that a pretty good turn around time.

$3,500 sports gear: $116

$1,500 cameras: + $20

No Deductible

Hello State Farm - I think I'll be in good hands.